Quarterly Market Outlook: July 2021

Recovery reaches cruising speed

The vaccination process is progressing rapidly in developed economies and economic activity is returning to normal. Reopening economic indicators are surprisingly strong, and growth could reach record levels in the next quarters due to pent-up demand.

Growth is expected to remain strong in the short term and inflation to be high — although temporary — according to central banks. Their transition from thinking to talking and eventually tightening monetary conditions should not imply a major drawback for the business cycle. Global rates are still far below a neutral level, but periods of transition in monetary policy are often associated with upticks in market volatility.

The scenario should remain constructive for risk assets. Much of the good news is already discounted in current valuations so we expect less directionality in markets and recommend some neutrality in risk assets. After reaching cruising speed in record time, markets could experience some turbulence in the second half of the year.

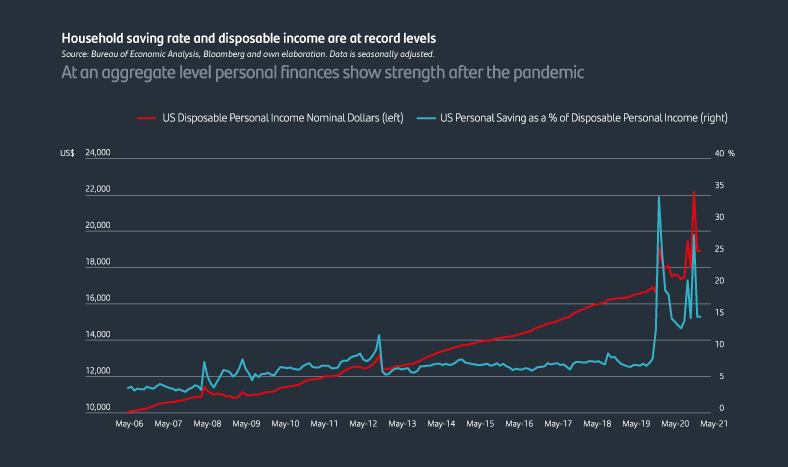

01. US consumers' financial health supports a surge in spending

The U.S. economy, flush with COVID-19 stimulus money and a succesful nationwide vaccination campaign, is picking up steam and leading the world towards a stronger economic growth. Consumers in developed economies enjoy a degree of financial health that will foster a solid consumption demand in the coming quarters as the global economy advances towards a new self-sustained phase.

Moreover, savings and increases in financial asset and real property prices have driven an unprecedentedly rapid increase in household net worth as a share of GDP to support a surge in consumption.

Since consumers in aggregate didn’t take on more debt, balance sheets are strong and savings could spur consumption. The reopening of the consumer service sector is therefore likely to result in a burst of pent-up spending. That’s very different from the normally financially conservative post-recession behavior from consumers who, even as employment recovers, tend to remain cautious about spending. This is a different cycle.

Another important aspect is the recovery in labor markets. Not long ago, employment was about 10 million below the pre-pandemic level and the main issue was how to get all those workers back on the job. Now business surveys are full of comments about labor shortages and how employers are struggling to fill vacancies. However, in the US during the month of May 559,000 net jobs were created, unemployment rate fell to 5.8% (down from 6.1% in April) and wages accelerated to 2% year-over-year, adding pressure due to frictional factors on business margins.

02. Central banks are thinkg and talking about tightening

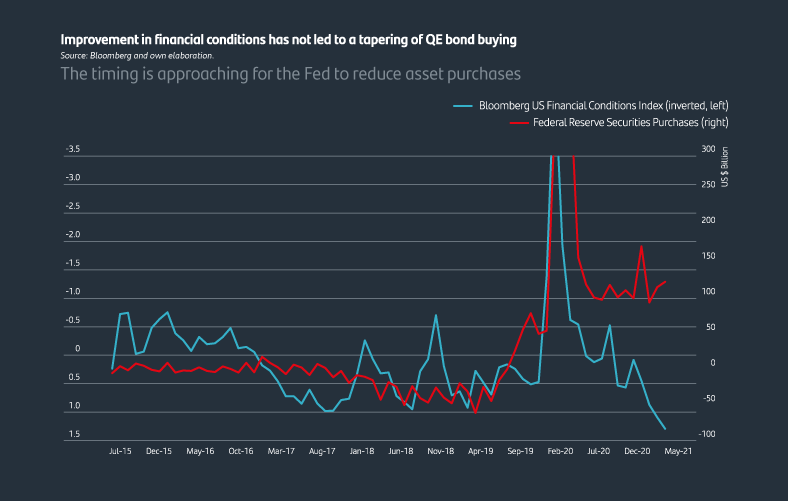

Supply/demand mismatches resulting from economic re-opening have caused inflation to spike during the past few months. Inflation should remain relatively strong for the remainder of the year but the current upward but the current upward pressure on prices will prove transitory. Our analysis suggests that while inflation pressures are going to be a near-term challenge, fundamentals do not corroborate a persistent inflation scenario. As consumer-price inflation surged in recent months, US and European government bond yields haven't followed.

High inflation and surging inflation expectations will test the Fed’s resolution during the next few months. The first step that monetary authorities will take in the process of withdrawing the dovish policies will be reducing its bond-buying stimulus (“tapering”). The Fed will start tapering its asset purchases when significant progress has been made towards its maximum employment target. The market will have to face the fact that central banks will soon reduce the size of their support to the economy.

In a second stage, Federal Reserve officials have long said that a key condition for raising interest rates is a return to maximum employment. Their evolving views about how much job growth that is needed could lead them to roll back support for the economy sooner than previously expected.

Moreover, Biden has begun his term with an ambitious fiscal plan that will be difficult to pass because of its large amount and the high tax increases it entails. The economic cycle will need to face four hurdles in order to move forward: inflation, tapering and monetary and fiscal tightening.

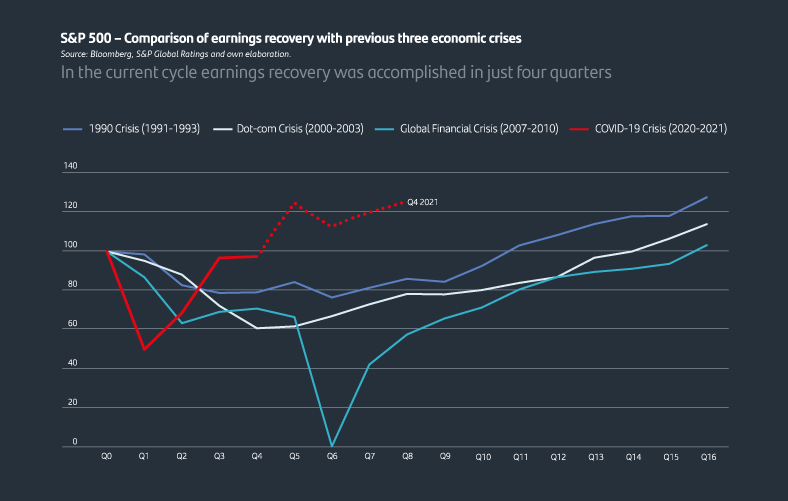

03. The cycle is moving really fast: Time for a pause?

The four stages of the economic cycle are also referred to as the business cycle. the most fascinating feature is how quickly everything has happened because of the phenomenal pace of this cycle. The downturn was the fastest on record, and much of the same can be said of the recovery. Companies have been able to repair their balance sheets and access credit markets at pre-pandemic levels of funding.

The strongest international earnings growth is occurring in cyclical sectors such as energy, financials, industrials and materials, which benefited the most by the improvement in the real economy. This trend is favoring regions that have the most exposure to these cyclical sectors, namely Europe and Japan, where cyclical sectors represent 55% of the market.

Financial markets are just starting to adjust to the reality that, eventually, monetary and fiscal policy will no longer be a strong tailwind to growth and could soon become a headwind. Currently, the market sentiment is very optimistic, technical factors appear stretched, volatility is low, and the options market has more participants trading on the upside than hedging against the downside.

Would you like further information?

Explore other articles

Explore other articles