Constructive but vigilant: investing through the AI supercycle

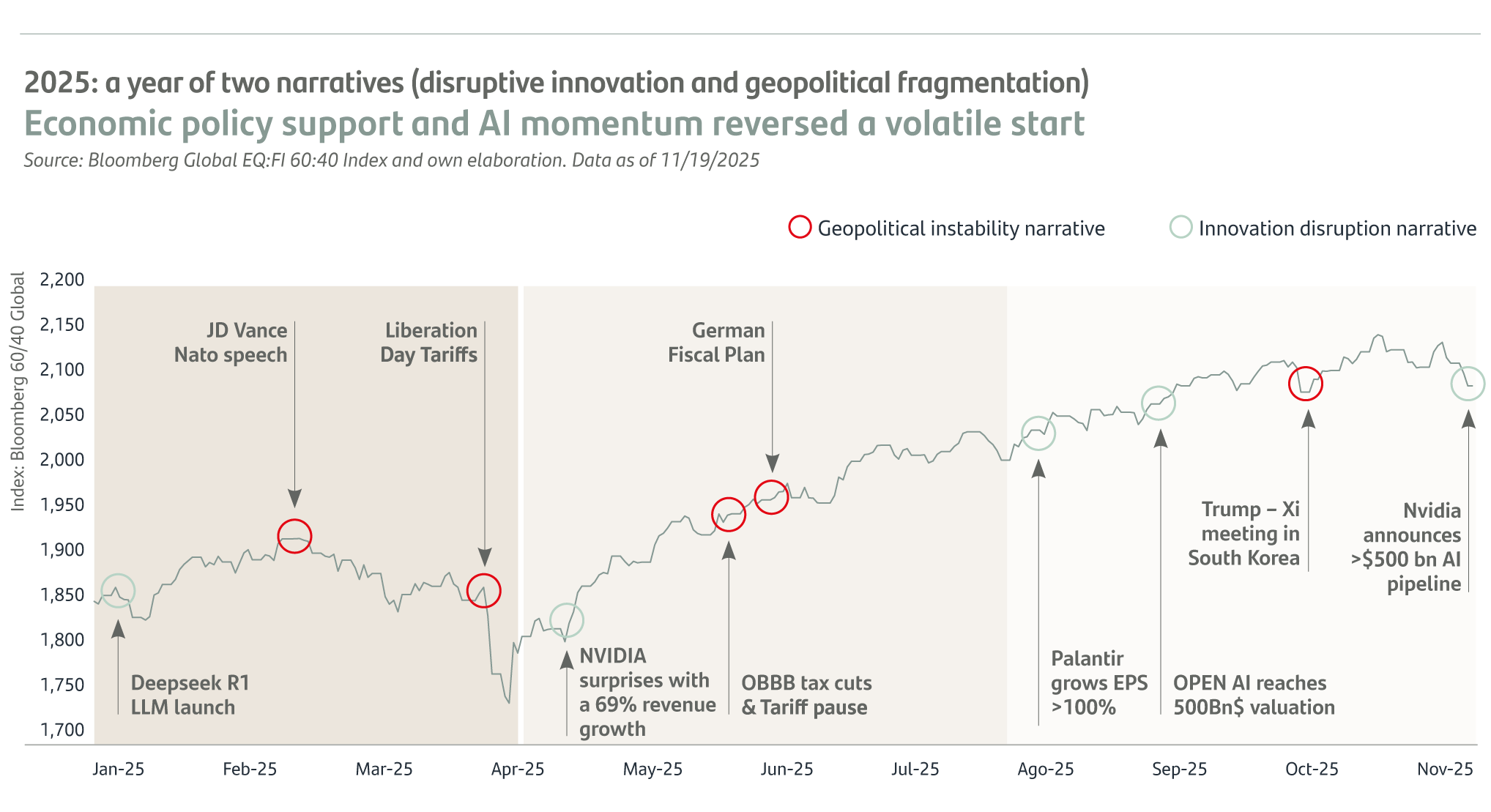

The year 2025 unfolded as a contest between two narratives. Early in the year, geopolitical fragmentation dominated headlines. The Liberation Day Plan in the United States reignited tariff tensions and triggered a sharp market correction, as investors questioned the durability of global trade and policy coordination.

As the year advanced, a second narrative gained momentum. The innovation cycle, fueled by record AI investment, gradually offset geopolitical stress. NVIDIA’s exceptional results in May, with a 69% surge in revenues, the record AI pipeline announced in November, and OpenAI’s valuation surpassing $500 billion later in the year, reinforced how innovation was driving profits and confidence. Fiscal support in the U.S. and Germany amplified this shift, and markets steadily recovered. As illustrated in the chart below, these alternating narratives defined market performance: volatility around policy shocks gradually gave way to renewed optimism as technological progress and capital spending took the lead. Even the Trump–Xi meeting in Seoul in late October — a symbolic reminder of geopolitical rivalry — failed to derail the uptrend.

This turning point echoed the message of the 2025 Nobel Prize in Economics, awarded to Joel Mokyr, Philippe Aghion and Peter Howitt for their work on innovation, knowledge diffusion and “creative destruction.” Their insight is timely: sustainable prosperity rests not on enthusiasm but on the capacity to translate innovation into measurable productivity.

That idea came to define the tone of the year’s closing months. By late 2025, the innovation narrative had prevailed. Markets rewarded progress over protectionism, and the focus turned from short-term shocks to long-term transformation. Across boardrooms, earnings calls and economists’ forecasts, the conversation shifted decisively toward innovation as the central driver of the next growth phase, This Global Market Outlook explores how investors can stay positioned – constructive on opportunity yet vigilant on risk - as the AI supercycle develops in a more fragmented world.

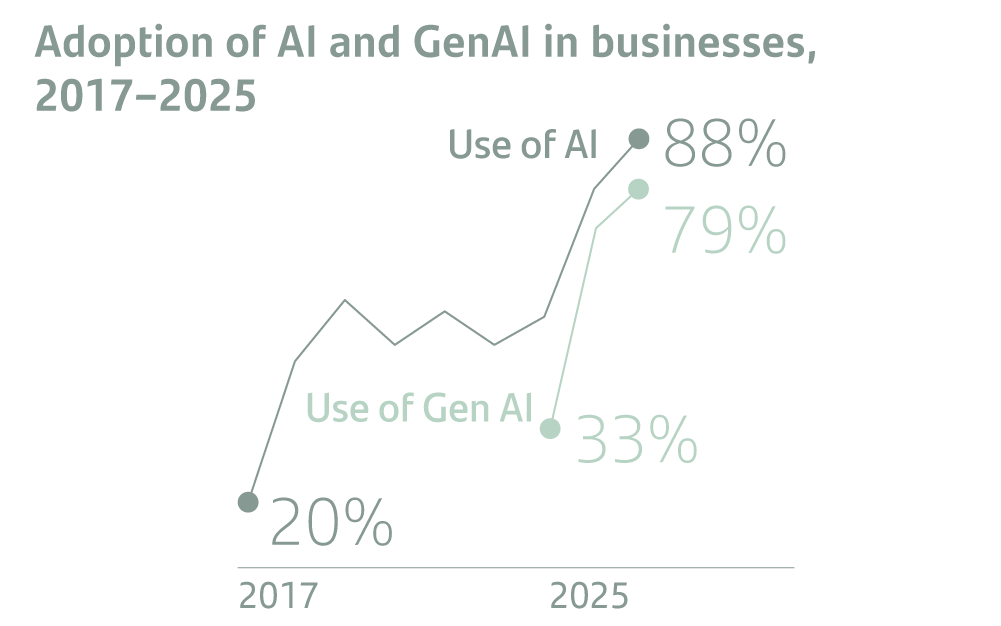

The title of this report reflects a conviction: technology is not a passing theme but the structural engine of global growth. The growing reach of digital infrastructure, automation and data across industries shows that technology has become the foundation of the economy. Artificial intelligence and robotics are accelerating this transformation, extending a long-term trend that began well before the current cycle.

The rally in global equities—especially in the United States—has been led by the technology sector. The exceptional performance has been decisive: these firms combine innovation, scale and profitability to lead digitalization and capture most of global earnings growth. Since 2020, their profits have risen by over 340%, while other major indices gained about 70%. This divergence illustrates how innovation has become the defining force behind market performance and the main source of value creation.

The rise of artificial intelligence reinforces this dynamic. AI is not creating a new technological cycle; it is amplifying one already reshaping every sector. As intelligent systems and automation become embedded in production, services and finance, technology is evolving from a single industry into the operating system of the global economy—the platform through which growth, productivity and competitiveness are defined.

Still, history counsels prudence. Transformative technologies often fuel exuberance that stretches valuations beyond fundamentals. Every great innovation—from railways to the internet—has mixed genuine progress with phases of overinvestment. The AI boom looks more resilient but is not immune to misallocation or inflated expectations. Amara’s Law holds: we overestimate technology’s short-term impact and underestimate its long-term power.

For investors, the opportunity is real but demands discipline. Maintaining a constructive approach to innovation while ensuring disciplined capital allocation is essential. Success will hinge less on chasing momentum and more on identifying where AI drives real productivity, sustainable margins and lasting value. Optimism must rest on evidence, not euphoria.

While artificial intelligence dominates this cycle, it is not its only engine of growth. Policy support, structural transformation and the shift toward more neutral monetary conditions sustain a constructive outlook. Fiscal cuts in the United States and new investment plans in infrastructure and defence across Europe are boosting demand and employment, offsetting trade frictions. On the monetary front, the gradual move toward neutral rates is easing financial conditions and expanding credit, creating a more supportive environment for investment and risk assets.

Beyond the short term, structural forces are reshaping global growth. AI leads this transformation together with automation, the energy transition and re-industrialisation. Electrification, clean energy and industrial modernisation are building a new investment landscape where policy and technology act in concert. These trends support a more balanced and diversified expansion but also demand discipline: fiscal expansion is approaching its limits and public finances are again centre stage. Meanwhile, geopolitical tensions and trade fragmentation continue to call for active, diversified and prudent management.

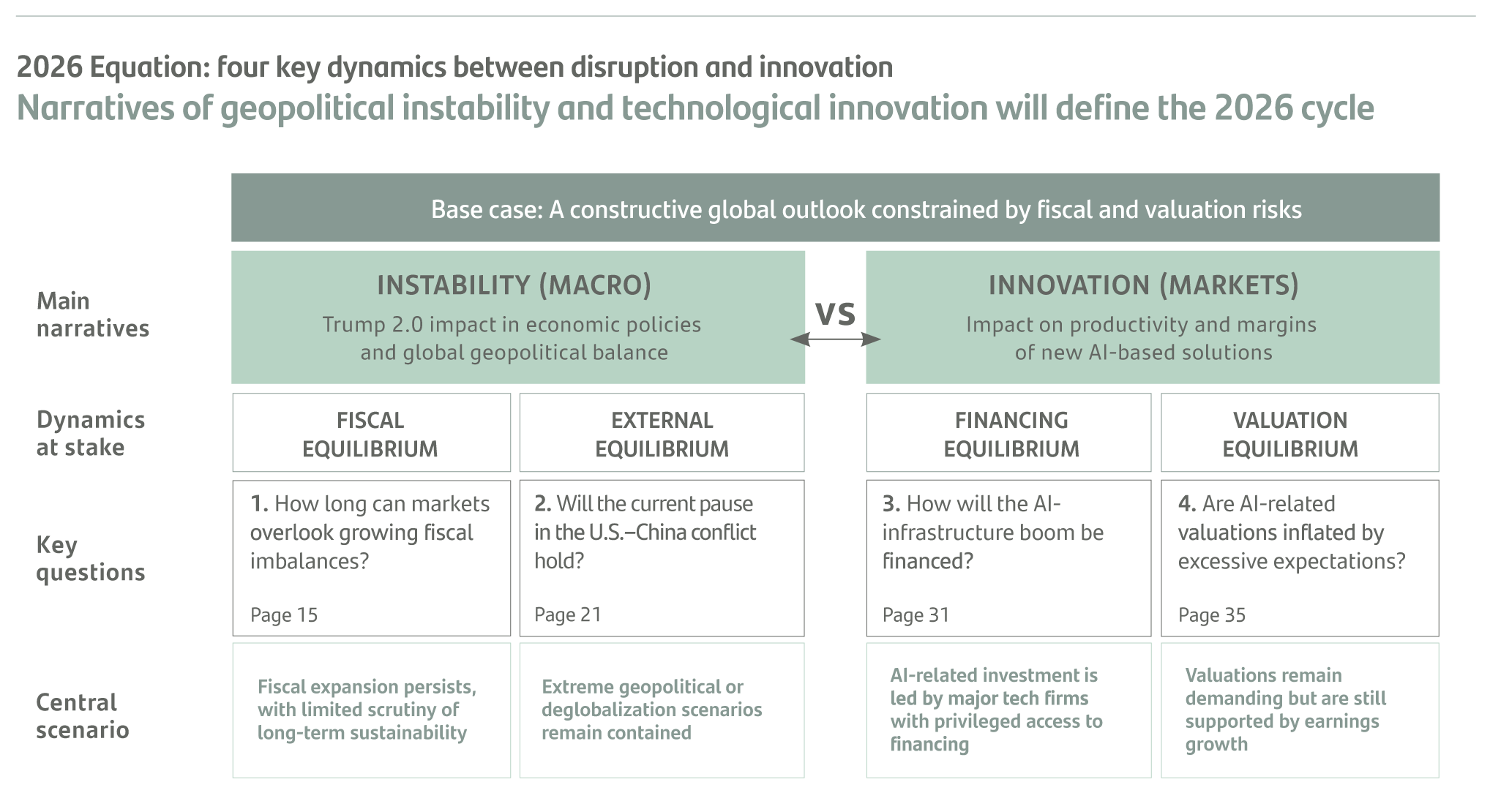

In this context, the report is organised around the Equation for 2026, shown in the diagram below, which summarises the forces that will shape the cycle. Four dimensions—fiscal policy, global trade, credit and valuation— define the balance between instability and innovation, between policy and markets. Each highlights a key challenge: fiscal sustainability, adaptation of trade to a new geo-economic order, financing the AI-driven capex boom, and whether current valuations remain justified after an exceptional earnings cycle. We dedicate specific sections of the report to address these four key questions.

These dimensions underpin the key questions that guide our analysis and connect the macro narrative with market strategy. They also lead to the identification of the main investment opportunities across four structural themes: the industrial renaissance, the rise of AI agents, the impact of lower interest rates and the rebalancing of global security. Together, they provide the roadmap for disciplined investing in a cycle defined by innovation and transformation.

What lies ahead in 2026?

A look at key themes and investment strategies

Important Legal Notice

This document has been prepared by Santander Wealth Management & Insurance Division, a global business unit of Banco Santander, S.A. (“WMI”, together with Banco Santander, S.A. and its affiliates, “Santander”). This document may contain economic forecasts and information from multiple sources, including third parties believed to be reliable, but Santander does not guarantee their accuracy, completeness or timeliness and may change them without notice. Opinions herein may differ from those expressed by other Santander units.

This document is solely for information purposes; it is not investment advice and is not tied to any specific investment objective or investor suitability criteria. It does not constitute an offer or solicitation to buy or sell any asset, contract, or product (collectively, the “Financial Assets”) and should not be relied upon as the sole basis for any evaluation. Receipt of this document does not create an investment‑advisory relationship nor any kind of obligation for “WMI” or “Santander”.

The content of this document has been partially generated with the assistance of artificial intelligence.

Santander gives no warranty on forecasts or on the current or future performance of any market or Financial Asset; past performance is not a reliable indicator of future results. Financial Assets may be ineligible for sale in some jurisdictions or to some investor categories.

Except where expressly stated in the legal documents governing a Financial Asset, such assets are not insured or guaranteed by any governmental entity (including the FDIC), are not bank deposits, and involve risks (market, currency, credit, liquidity, counterparty) including possible loss of principal. Investors should consult their own financial, legal and tax advisers to determine suitability and assess the Financial Asset. Santander and its employees accept no liability for any loss arising from use of this document.

Santander or its employees may hold positions in, act as principal or agent for, or provide services to issuers of, the Financial Assets referenced.

The information herein is confidential and may not be reproduced or distributed without WMI’s prior written consent. Any third‑party material remains the property of its owner and is reproduced in accordance with fair‑industry practice.

Certain complex or high‑risk products may be offered only to Professional Clients or may be deemed inappropriate for Retail Clients.

Country-specific addenda

European Economic Area: for Retail, Professional & Eligible Counterparties

This is an informative communication. Complex instruments may be unavailable or inappropriate for retail investors.

United Kingdom: for Retail & Professional Clients

Financial promotion approved by an FCA‑authorized firm under COBS 4; risk warnings must be fair, clear, and not misleading and as prominent as the main text. Retail Clients receive no personalized advice and may be restricted from complex products.

SPBI (Banco Santander International (USA) and/or Banco Santander

International SA (Switzerland, including its Bahamas Branch and DIFC Branch in United Arab Emirates): for Private, Professional and Institutional Clients

This material is not directed to people who are citizens of, domiciled or resident in, or entities registered in a country or a jurisdiction in which its distribution or use would violate local laws and regulations. This material contains information gathered from several sources, including trade, statistical, marketing, economic forecasts, and other sources. The information contained in this material may have also been gathered from third parties, but such information may not have been corroborated by Santander and Santander assumes no liability whatsoever for such information. The accuracy or completeness of this information is not guaranteed and is subject to change without notice. Any opinion expressed in this material could differ or be contrary to opinions expressed by other members of Santander. Santander does not currently have a position on Environmental, Social and Governance ESG investment considerations, and any ESG metrics and/or comparisons of client portfolios to ESG benchmarks set forth in this material have been gathered from third parties and are included solely for convenience. The information contained in this material is of a general nature and is intended for illustrative purposes only. It does not pertain to particular jurisdictions, and it is not in any way applicable to specific situations or people. Likewise, it does not represent an exhaustive and formal analysis of the topics discussed or establish an interpretive or value judgment about the scope, application, or viability thereof.

This material is not intended to be and should not be construed as investment advice. This material is published solely for informational and marketing purposes and is not a prospectus or other similar informational material. This material does not constitute an offer or solicitation to purchase or sell securities or products of any type (collectively, the Securities and should not be relied upon as the sole basis for evaluating or assessing Securities. Additionally, the distribution of this material to a client, or to a third party, should not be regarded as a provision or an offer of investment advisory services.

Santander makes no representation or warranty of any kind in connection with any forecasts or opinions, or with the Securities stated in this material, including about the current or future performance. The past or present performance of any Securities may not be an indicator of such future performance. Performance results included in this material do not reflect the deduction of any applicable fees. The rate of return of an investor will be reduced by the applicable distribution, advisory or management fees, carried interests, any expenses incurred by the funds, and other applicable fees and charges.

The Securities described in this material may not be eligible for sale or distribution in certain jurisdictions or to certain categories or types of investors.

This material is strictly private and confidential and is being distributed to a limited number of clients and must not be provided nor be transmitted to any person other than the original recipient and may not be reproduced, published, or used for any other purpose.

Except as otherwise expressly provided in the legal documentation of specific Securities, the Securities mentioned in this material are not, and will not be, insured or guaranteed by any governmental entity, including, but not limited to, the Federal Deposit Insurance Corporation (FDIC) and the Swiss Financial Market Supervisory Authority FINMA or the Dubai Financial Services Authority DFSA are not deposits or other obligations of, or guaranteed by, Santander, and may be subject to investment risks including, but not limited to, market and currency exchange risks, fluctuations in value, and possible loss of the principal invested.

No supervisory authority has approved this material nor taken any steps to verify the information set out in this material and has no responsibility for it.

The information provided in this material does not constitute tax or Legal advice. In connection with the Securities, any investor should conduct their own independent investigation and research and should consult such financial, legal, tax and other advisers to determine whether the Securities are suitable based on such investors particular circumstances and financial situation. If you have any questions about this material or your investments, please contact your banker or an authorized financial advisor. Santander, their respective directors, officers, attorneys, employees, or agents assume no liability of any type for any loss or damage relating to or arising out of the use or reliance of all or any part of this material.

In connection with the Securities stated in this material, Santander and their respective directors, officers, employees or agents: (i) may have or have had interests in the Securities (whether long positions, short positions or otherwise); (ii) may at any time make purchases or sales in the Securities as principals or agents; (iii)may act or have acted as advisor, underwriter, distributor, director, manager or officer of the companies referred to in this material; (iv) may receive compensation, either directly or indirectly, from third parties in connection with the Securities; or (v) may have, or may seek to have, business relationships or financial interests with the companies contained in this material and such business relationships or financial interests could affect the objectivity of the information contained in this material.

Brazil: for Retail, Qualified & Professional Investors

This material is for informational purposes only and does not constitute an offer of financial products or services under Brazilian law. The investments presented herein may not be suitable for your objectives, financial situation, or individual needs. In Brazil, the completion of the suitability form is essential to ensure the alignment of the client's profile with the chosen investment product or service. It is strongly recommended that the conditions of each product be carefully reviewed prior to investing. This material does not constitute an analysis report under the terms of Resolution 20/2021 from the Comissão de Valores Mobiliários.

Mexico: for Retail & Institutional Investors

Public offers to retail investors require a prospectus registered with the CNBV; complex products may be placed only under private‑placement exceptions with Institutional or Sophisticated Investors.

Chile: for Retail & Qualified Investors

This document is directed solely to Banco Santander-Chile customers and is for informational purposes only. Any recommendations made by Santander are provided for informational purposes only and do not bind the Customer, impose any obligations on Santander, or give rise to any liability of any kind for Santander in this matter. The information contained in this document comes from sources we consider reliable; however, we do not guarantee the correctness or completeness of its content, and its inclusion does not constitute a guarantee of its accuracy. Investors should be aware that such information may be incomplete or summarized. This document has been provided for informational purposes only and does not constitute a prospectus, an offer to sell, or a solicitation to buy or sell any security, investment fund, or interest in any investment product.

Other Asia / MENA / LATAM: As classified locally

Retail disclosure, prospectus and suitability rules follow local law; complex cross‑border products often restricted to institutional investors.

Special Disclaimer for Banco Santander International SA (DIFC Branch): for Professional Clients & Market Counterparties only

Banco Santander International SA (DIFC Branch) is a branch of Banco Santander International SA, and it is registered in the Dubai International Financial Center (“DIFC”) and regulated by the DFSA under prudential Category 4 to conduct financial services activities in and form the DIFC. The DIFC Branch markets and promotes a wide suite of products and services offered by the group and provides advisory and arranging services in relation to private banking solutions offered by Banco Santander International SA. Capitalized terms used in this section have the meanings set forth in the DFSA Rulebook Glossary Module.

Financial services or products offered by Banco Santander International SA (DIFC Branch) are only made available to Professional Clients or Market Counterparties.

Banco Santander International SA (DIFC Branch) does not have a Retail Client Endorsement on its DFSA License and as such is not able to provide services to Retail Clients (as defined in the DFSA Conduct of Business Module). Therefore, this material is intended for distribution only to Professional Clients (as defined in the DFSA Conduct of Business Module) and must not be delivered to, or relied on by, any other person.

Banco Santander International SA (DIFC Branch) does not carry on any Financial Service in or from the DIFC in accordance with Sharia, and does not, as part of its DIFC product offering, offer or promote financial products on the basis that such products meet the standards to be Sharia compliant. If necessary, you should seek independent advice from a qualified third party on the Sharia compliance or otherwise of a financial product or service.

Special Disclaimer for Funds

If this material relates to the offering of units in a Fund (as defined in the Collective Investment Law DIFC Law No. 2 of 2010), please note that the Fund is not subject to any form of regulation or approval by the DFSA, and, the DFSA has no responsibility for reviewing or verifying any Prospectus or other documents in connection with units in a fund. The Units (as defined in the Collective Investment Law DIFC Law No. 2 of 2010) to which this material, prospectus of the Fund or other associated documents relate, may be illiquid and/or subject to restrictions on their resale. Prospective purchasers should conduct their own due diligence on the Units. A copy of the Fund Prospectus is available for review upon request. If this information relates to the offering of units in a Money Market Fund (as defined in the DFSA Collective Investment Rules), the investor should be aware of the different nature of a unit in a Money Market Fund compared to a Deposit (as defined in the DFSA Collective Investment Rules).

The capital of an investment in a Money Market Fund is not guaranteed and there is a risk that any investor may lose some or all their capital investment. Investors should be aware that the value of the units in Money Market Funds may fluctuate depending on a number of factors including but not limited to, market risk, foreign exchange risk and counterparty risk. Financial services or products are only available to Professional clients or Market Counterparties as defined by the Dubai Financial Services Authority. If you do not understand the contents of this document, you should consult an authorized financial adviser.

In relation to its use in the Dubai International Financial Centre, this material is strictly private and confidential and is being distributed to a limited number of investors and must not be provided to any person other than the original recipient and may not be reproduced or used for any other purpose. The interest in the international shares may not be offered or sold directly or indirectly to the public in the Dubai International Financial Centre.

Banco Santander International SA (DIFC Branch) is located in Gate District 4, West, Level 4, DIFC, Dubai, UAE.

For more information contact: info-DIFC@pbs-santander.com