Market Outlook

Discover our key messages and possible investment strategies to follow

Here you can find perspectives on markets, trends and other stories of interest, as well as learn more about our business.

Discover our key messages and possible investment strategies to follow

Our investment team analyzes the main themes and the latest market trends

Get our annual report for a first-hand account of how our teams see the markets performing and the investment opportunities in 2026

Get our quarterly report for a first-hand account of how our teams see the markets performing and the investment opportunities in Q4 2025

Get our quarterly report for a first-hand account of how our teams see the markets performing and the investment opportunities in Q3 2025

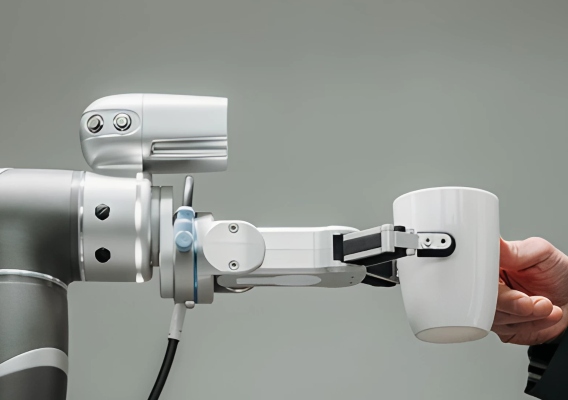

The robotics industry has entered a more dynamic phase of development and we believe it will become dominant over the next decade.

Since they tend to be at an earlier stage of development, small cap companies tend to expand faster, which can provide greater appreciation for investors in the long term

Private credit has rapidly evolved from being a niche financing option to a significant and institutionalized asset class, driven primarily by regulatory changes and investor preferences.

Thematic investing refers to strategies through which investors can invest in megatrends, capturing opportunities arising from structural changes in society that transcend economic cycles. In other words, thematic investing is about transforming megatrends into investment opportunities.

Yield levels of most fixed income asset classes remain attractive from a historical point of view despite the good performance of 2023.

The recent emergence of generative artificial intelligence (AI) is a clear example of the massive, rapid adoption of a technological innovation that is having a major impact on society and all sectors of the economy.

Get our quarterly report for a first-hand account of how our teams see the markets performing and the investment opportunities in Q4 2025