Sustainable Bonds: Fixed income that drives the change

Sustainable bonds have become essential instruments for channeling capital towards environmental and social progress while meeting investors’ expectations for risk-adjusted returns. [+]

Sustainable bonds are fixed income instruments designed to finance/re-finance green/social projects or support corporate sustainability performance improvements.

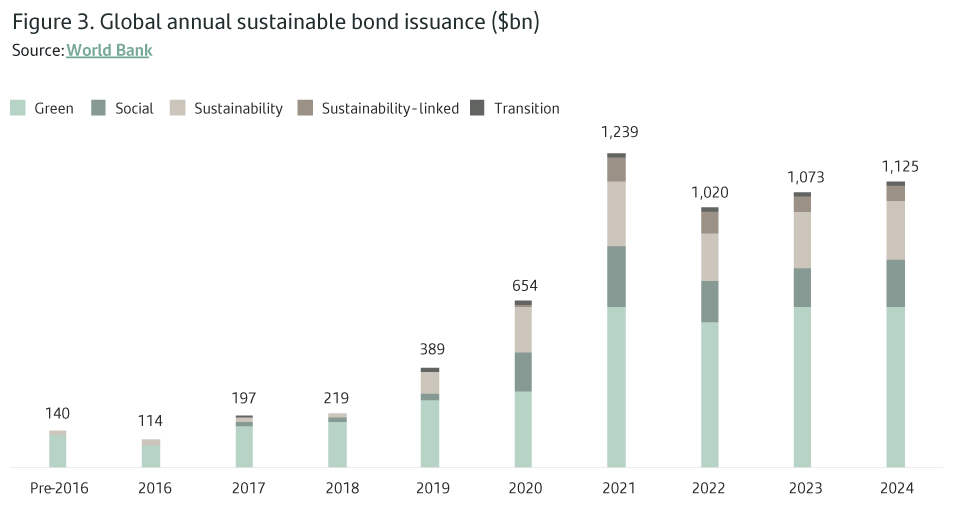

The sustainable bond market has increased significantly since the first issues back in early 2000s, reaching c.$ 1tn annual issuance since 2021, with cumulative volumes exceeding of $6tn since inception. [+]

1. What are Sustainable Bonds?

Sustainable bonds (often referred as GSS+ bonds [+] are fixed income instruments focused on sustainability, that typically follow the ICMA Principles [+].

Main types are:

Green Bonds

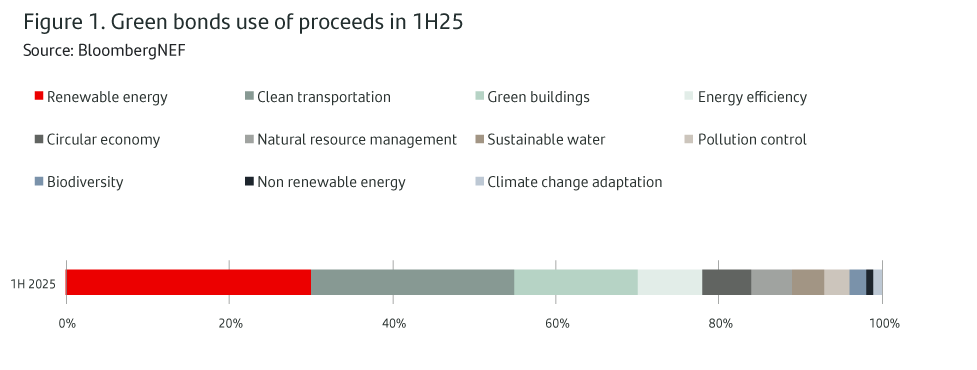

Their Use of Proceeds (UoP) is exclusively focused on green projects aimed at generating positive environmental impact such as renewable energy, energy efficiency, pollution prevention, clean transportation, or sustainable water management. [+] As the market keeps developing, subsegments of green bonds have recently emerged, including:

- European Green Bonds (EuGB)

- Blue Bonds

- Nature-themed Bonds

Social Bonds

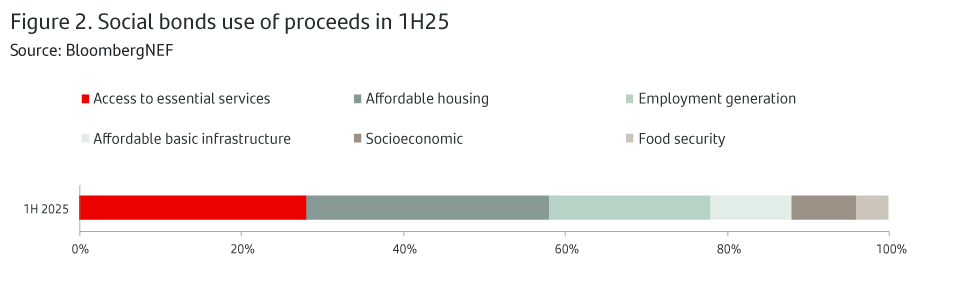

UoP is exclusively focused on projects seeking positive social outcomes, that include affordable housing, affordable basic infrastructure, access to essential services like healthcare, employment generation programs, food security/sustainable food systems, access to education, and socioeconomic advancement. [+]

Sustainability Bonds (green + social)

Where the UoP is exclusively focused on a mix of the above mentioned green and social projects, aligned with the core components of green and social bonds. [+]

Sustainability-Linked Bonds (SLBs)

Are forward-looking performance-based instruments, whose financial characteristics depend on the issuer’s sustainability improvements). In this type, proceeds are used towards general purposes. [+] [+]

Transition bonds

They can be structured as UoP, where proceeds are exclusively used in projects tackling climate transition initiatives, or towards more sustainable practices in a KPI-linked structure.

Cat (catastrophe) bonds, are a different type of instruments (also not part of the ICMA Principles), but very linked to climate change. They are used to transfer risk from the (re)insurance industry to other investors, allowing the issuer to avoid repaying the bond’s principal if, and only if, catastrophic conditions occur under defined triggers.

2. Upward market volumes and main issuers

According to the World Bank, labelled sustainable bonds have consistently surpassed $1tn annual issuance after reaching its peak in 2021.

Green bonds are the largest category, comprising over 50% of the volume issued.Social bonds saw a significant increase after the COVID 19 pandemic (experienced a 10-fold increase YoY in 2020) but have plateaued since. [+] Europe remains the largest issuer.

3. Fixed income instruments with same profitability but different focus

Referred to as the green premium or “greenium”, yield data reported discounts of 3-8bps for green instruments versus comparable vanilla options. [+]

For emerging markets, where there are less issuances, according to MSCI greenium is reportedly higher, c.11bps. [+] explained by Chinese Yuan denominated bonds. Moreover, greenium is also influenced by sectors and issuers.

Currently greenium has been reduced to non significant low-single digit levels in developed markets, specially since 2024. [+]

Main reasons to explain this evolution are:

- Green bonds are no longer a novelty

- Stabilisation of inflows into sustainable-focused funds

- Rates increase

- Transparency improved

4. Conclusions

Sustainable bonds are compelling, fixed income investment instruments to finance green/social projects and climate transition towards a more resilient global economy. The development of a sizeable market for these instruments reflects a maturing context that is increasingly capable of mobilizing capital towards global sustainability priorities.

Important Legal Information

This document has been prepared by Banco Santander, S.A. ("Santander") for information purposes only and is not intended to be, and should not be construed as, investment advice, a prospectus or other similar information material.

This material contains information compiled from a variety of sources, including business, statistical, marketing, economic and other sources. The information contained in this material may also have been compiled from third parties, and this information may not have been verified by Santander and Santander accepts no responsibility for such information.

Any opinion expressed in this document may differ from or contradict opinions expressed by other members of Santander. The information contained in this material is of a general nature and is provided for illustrative purposes only. It does not relate to any specific jurisdiction and is in no way applicable to specific situations or individuals. The information contained in this document is not an exhaustive and formal analysis of the issues discussed and does not establish an interpretative or value judgement as to their scope, application or feasibility. Although the information contained in this document has been obtained from sources that Santander believes to be reliable, its accuracy or completeness is not guaranteed. Santander assumes no responsibility for the use made of the information contained herein.