Quarterly Market Outlook: Q3 2022

Focus on quality while growth outlook is uncertain

The first half of this year has delivered a number of adverse shocks that dramatically raised inflation while significantly weighing on growth.

We believe that volatility and uncertainty will remain high until there is an inflection point in the rising path of inflation. Until then, investors will be questioning whether the increase in interest rates that central banks have implemented thus far is sufficient to control inflation. The risk is that by tightening policy aggressively even as growth is threatened by the conflict, central banks could trigger a recession. The credibility of central banks is at stake as inflation at 40-year highs poses the toughest of policy challenges.

As uncertainty about interest rates and growth persists, we believe it makes sense to maintain portfolios with moderate levels of risk focused on quality: profitable companies with strong cash flow generation, low debt and liquidity needs and high and stable margins. Diversification in real assets (commodities, direct real estate, etc.), private markets, capital protection structured products and absolute return strategies will be key in this complex investment environment.

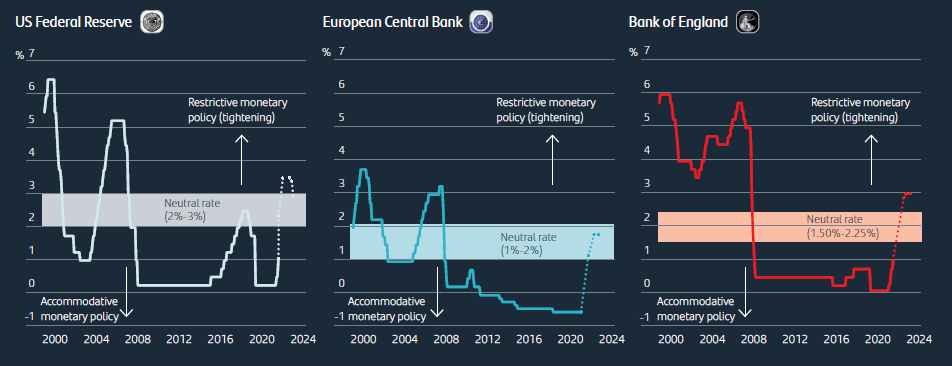

01. Tackling inflation is the #1 priority

Fixed income markets have made a profound adjustment to incorporate a new scenario in which monetary conditions have ceased to be ultraloose. Still, inflation numbers keep on showing higher readings, and this is introducing a new factor of uncertainty: the market is wondering about the level of demand that needs to be removed to ease price pressures. We believe that inflation data should start to moderate in the coming quarters as key base effects are removed, but this scenario has points of fragility that may lead to a scenario of interest rate hikes beyond market estimates. Central banks stake their credibility in this complex environment as they face dilemmas in meeting conflicting targets.

Inflation is forcing central banks to push rates above the neutral rate to moderate excessive demand pushing prices up

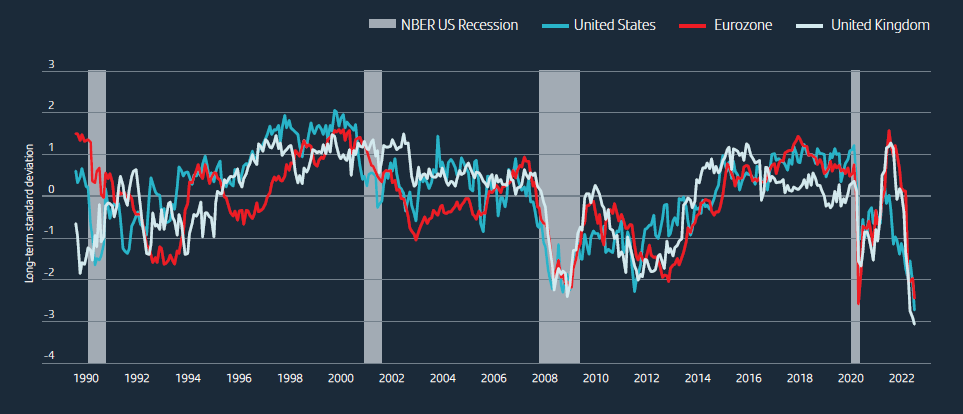

02. Crack in the growth outlook

The deterioration in leading indicators is becoming widespread and the high levels of growth expected at the beginning of the year are starting to fade to levels that open the debate of a potential recession in the next twelve months. The continuity of the economic cycle will depend on the level of monetary tightening and the level of deterioration in consumer and business confidence. We analyze several sources of fragility that could trigger a scenario of greater economic slowdown: energy shortages in Europe, gridlock and financial conditions in the United States and the crisis in the real estate market in China.

The deterioration in consumer confidence has been surprising in its speed and magnitude

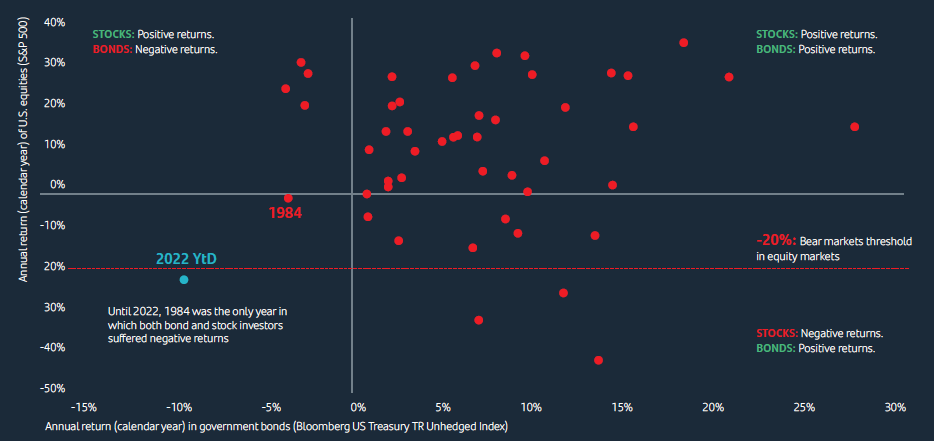

03. Defensive bias and diversification

Rising inflation poses a major challenge for asset allocation as it negatively affects both bonds and equities. Risk management is key in this environment of macro and geopolitical uncertainty until the scenario about interest rates and growth becomes clearer. We would suggest maintaining portfolios with a low-risk budget, diversification in real assets (commodities and real estate) and alternative investments, focus on balance sheet quality and resilient dividends and cashflows in company selection, and risk management via structured products and absolute return strategies.

Annual returns of a US$ investor in equities (S&P500) and fixed income (U.S. Treasuries)

Would you like further information?

Check out our previous reports

Legal Notice

This report has been prepared by Santander Wealth Management & Insurance (“WMI”), a global business unit of Banco Santander, S.A. (WMI, together with Banco Santander, S.A. and its affiliates, shall be referred to hereinafter as “Santander”). This report contains economic forecasts and information gathered from several sources, including third parties. While said sources are believed to be reliable, the accuracy, completeness or current nature of that information is not guaranteed, either implicitly or explicitly, and is subject to change without notice. Any opinions included in this report may not be considered irrefutable and could differ from, or be inconsistent with, opinions (expressed verbally or in writing), advice or investment decisions of other areas of Santander.

This report is not intended to be, and should not be, construed in relation to a specific investment objective. It has been published solely for information purposes and does not constitute investment advice, an offer or solicitation to purchase or sell assets, services, financial contracts or other types of agreements, or other investment products of any type (collectively, the “Financial Assets”), and should not be relied upon as the sole basis for evaluating or assessing Financial Assets. Likewise, the distribution of this report to a client, or to a third party, should not be regarded as a provision or an offer of investment advisory services.

Santander makes no warranty in connection with any market forecasts or opinions, or with the Financial Assets mentioned in this report, including with regard to their current or future performance. The past or present performance of any markets or Financial Assets may not be an indicator of such markets or Financial Assets future performance. The Financial Assets described in this report may not be eligible for sale or distribution in certain jurisdictions or to certain categories or investors.

Except as otherwise expressly provided for in the legal documents of specific Financial Assets, the Financial Assets are not, and will not be, insured or guaranteed by any governmental entity, including the Federal Deposit Insurance Corporation. They are not an obligation of, or guaranteed by, Santander, and may be subject to investment risks including, but not limited to, market and currency exchange risks, credit risk, issuer and counterparty risk, liquidity risk and possible loss of the principal invested. In connection with the Financial Assets, investors are recommended to consult their financial, legal, tax and other advisers as they deem necessary to determine whether the Financial Assets are suitable based on such investors particular circumstances and financial situation. Santander, its respective directors, officers, attorneys, employees and agents assume no liability of any type for any loss or damage relating to, or arising out of, the use or reliance of all or any part of this report.

At any time, Santander (or its employees) may align with, or be contrary to, the information stated herein for the Financial Assets; act as principal or agent in the relevant Financial Assets; or provide advisory or other services to the issuer of relevant Financial Assets or to a company connected with an issuer thereof.

The information contained in this report is confidential and belongs to Santander. This report may not be reproduced in whole or in part, or further distributed, published or referred to in any manner whatsoever to any person, nor may the information or opinions contained herein be referred to without, in each case, the prior written consent of WMI.

Santander Private Client” is a brand name trademarked by Santander Bank, N.A. and may be used by its affiliates. Securities and insurance products are not offered by “Santander Private Client” or Santander Bank, N.A.

Any third party material (including logos, and trademarks), whether literary (articles/studies/ reports, etc. or excerpts thereof) or artistic (photos/graphs/drawings, etc.), included in this report are registered in the name of their respective owners and only reproduced in accordance with honest industry and commercial practices.